How To Increase The Value Of A Business By Paying More Taxes

This article will discuss how to increase the value of a business by paying more taxes. To sell your business for the most money you need to report your actual income. If you have any thoughts of selling your business in the

EXAMPLE COMPANY

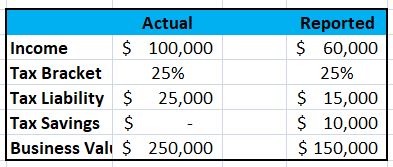

The consequence of underreporting income is $100,000 in this simplified example, but it is very common for small businesses to follow this practice. Not only will you leave $100,000 or more on the table, but you may not be able to sell your business at all. Entrepreneurs that have the capital or the ability to raise capital will want more than a living wage that can be verified on a tax return.

The other consequence comes when no lender will lend your buyer money because the tax returns don’t justify a loan for the sales price you’re asking. Buyers will require at least 3 years of business tax returns to verify income and get financing. Never understate revenue, but you can be generous with expenses; particularly discretionary expenses. Discretionary expenses are the expenses that a new owner doesn’t have to continue to run the business. For example, travel, entertainment, auto expense, training, etc… that are really owner perks that a new owner can run the business without. Discretionary expenses can be added back and explained to the new buyer. A consultation with your tax professional is wise when using this strategy so that you adhere to best practices. Every business will be sold one day; it’s just a matter of when and for how much… Make sure you report your income so you can cash out of your business on your terms. Click here to get more tips to increase the value of any company.